Portfolios that work for you now – and change with your needs

Clearwater Wealth Management recognizes that affluent families and individuals have sophisticated requirements. We will sit down with you to discuss your financial circumstances, asking the right questions, with the intention of learning what your expectations are for risk and return. With this understanding we will put together an investment strategy that is unique to you, selecting the right mix of investments consistent with your goals.

We understand that our clients’ lives and needs will change over time. And as your life evolves, we will be there to discuss your changing needs with you and adjust your portfolio to keep step.

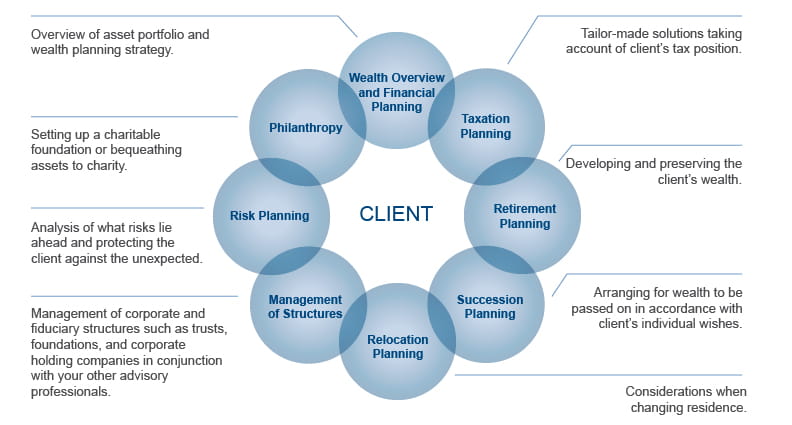

Clearwater Wealth Management consults with our clients to help them navigate through all facets of wealth management, such as investment selection, tax management, estate planning needs, philanthropy, risk protection, and transfer of wealth to the next generation.

Along with the resources we have available at Raymond James Ltd, we will also work seamlessly with your other advisors, such as your tax and legal professionals, to build one integrated team, working on your behalf.

Managing Risk

At Clearwater Wealth Management, we employ a rigorous multi-faceted approach to managing our risk-taking activities, and ensuring that they are aligned with our clients’ needs.

The three critical components:

-

Sound risk management is safeguarded by our portfolio monitoring team, our experienced internal compliance teams and our internal and external auditors.

-

We operate according to a strict code of ethics, and continually ensure that proper practice, controls, policies and procedures are in place. We also perform ongoing portfolio analysis to monitor for appropriate risk levels.

-

We employ the latest technology and comprehensive, proprietary risk management tools to automate processes and ensure overall quality compliance.